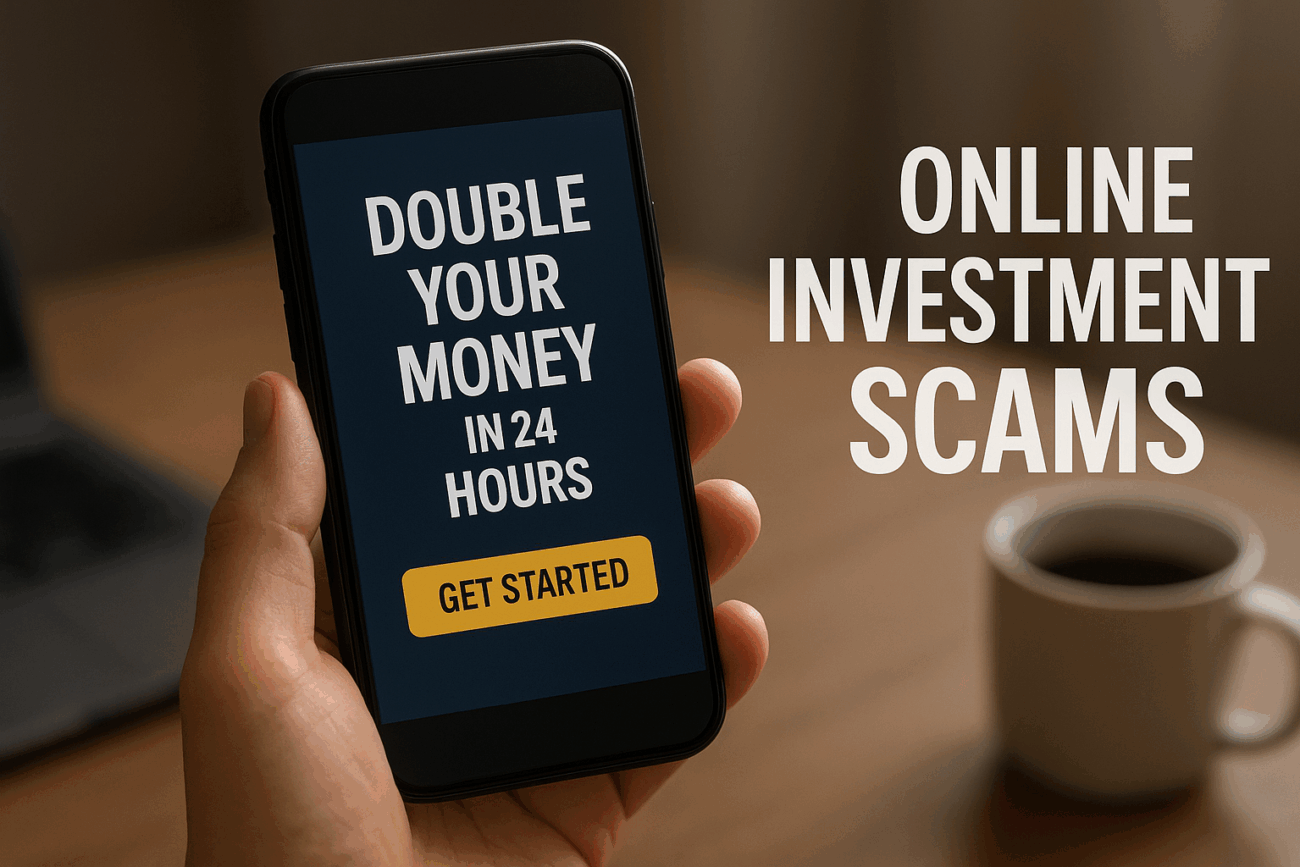

With the rise of digital finance and quick-return promises on social media, online investment scams are becoming more common than ever. From fake crypto schemes to fraudulent stock tips, scammers prey on people’s hopes of multiplying their money overnight. Understanding how these scams work is the first step in protecting yourself.

How Online Investment Scams Work

Most scams follow a similar pattern:

- Too-good-to-be-true promises – “Double your money in 24 hours” or “Guaranteed 50% monthly returns.”

- High-pressure tactics – Scammers push you to invest immediately, saying spots are limited.

- Fake credibility – They may use stolen photos of luxury lifestyles, fake testimonials, or impersonate legitimate financial firms.

- Vanishing act – Once you transfer funds, the website or contact disappears, and so does your money.

Common Types of Investment Scams

- Ponzi and pyramid schemes – Pay old investors with money from new ones until it collapses.

- Crypto scams – Fake coins, pump-and-dump groups, or fake exchanges.

- Phishing investment platforms – Websites that look real but are designed to steal your details.

- Impersonation fraud – Scammers pretending to be advisors, banks, or government officials.

Red Flags to Watch Out For

- Guaranteed high returns with little or no risk.

- Lack of clear company registration or regulation.

- Poorly designed websites with no real customer support.

- Pressure to “act now” before you miss the chance.

- Payments requested in cryptocurrency or gift cards.

How to Protect Yourself

- Verify credentials – Check if the company is registered with official regulators.

- Do your research – Search for reviews, complaints, or scam reports online.

- Avoid unsolicited offers – Especially on WhatsApp, Telegram, or social media.

- Never invest what you can’t afford to lose – Be cautious with high-risk platforms.

- Report scams – Notify cybercrime helplines or financial regulators in your country.

Final Thoughts

Scammers thrive on urgency, secrecy, and the promise of easy money. Remember: if it sounds too good to be true, it probably is. Protect your hard-earned money by staying informed, skeptical, and always double-checking before investing.